A chart of accounts is a critical tool for tracking your business’s funds, especially as your company grows. Without a chart of accounts, it’s impossible to know where your business’s money is. The chart of accounts is like a map of your business and its various financial parts.

What are the best practices for integrating a chart of accounts with accounting software or ERP systems?

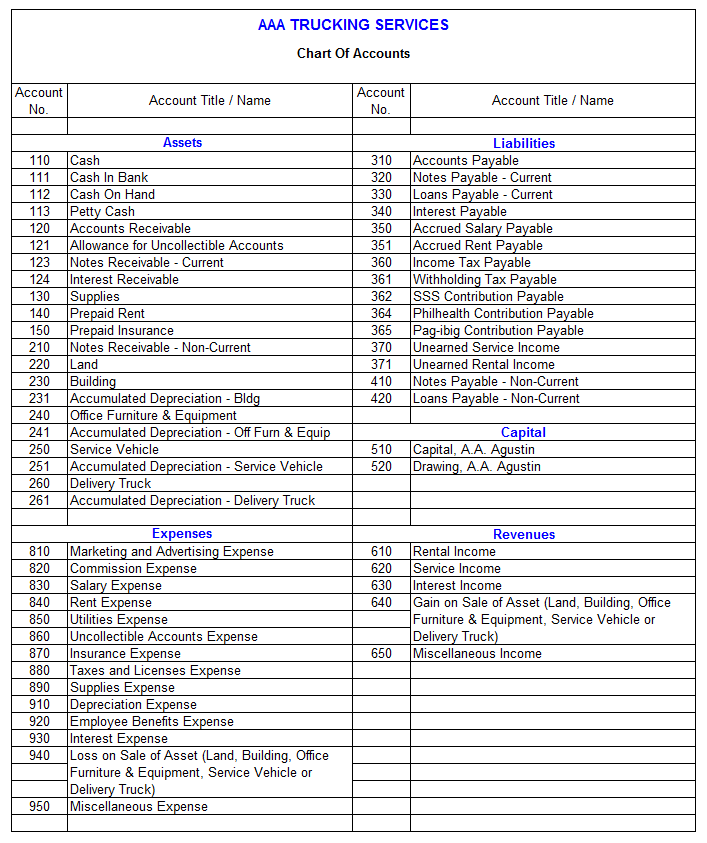

This would include Owner’s Equity or Shareholder’s Equity, depending on your business’s structure. The basic equation for determining equity is a company’s assets minus its liabilities. For example, a company may decide to code assets from 100 to 199, liabilities from 200 to 299, equity from 300 to 399, and so forth. Those could then be broken down further into, e.g., current assets ( ) and current liabilities ( ).

The balance sheet accounts

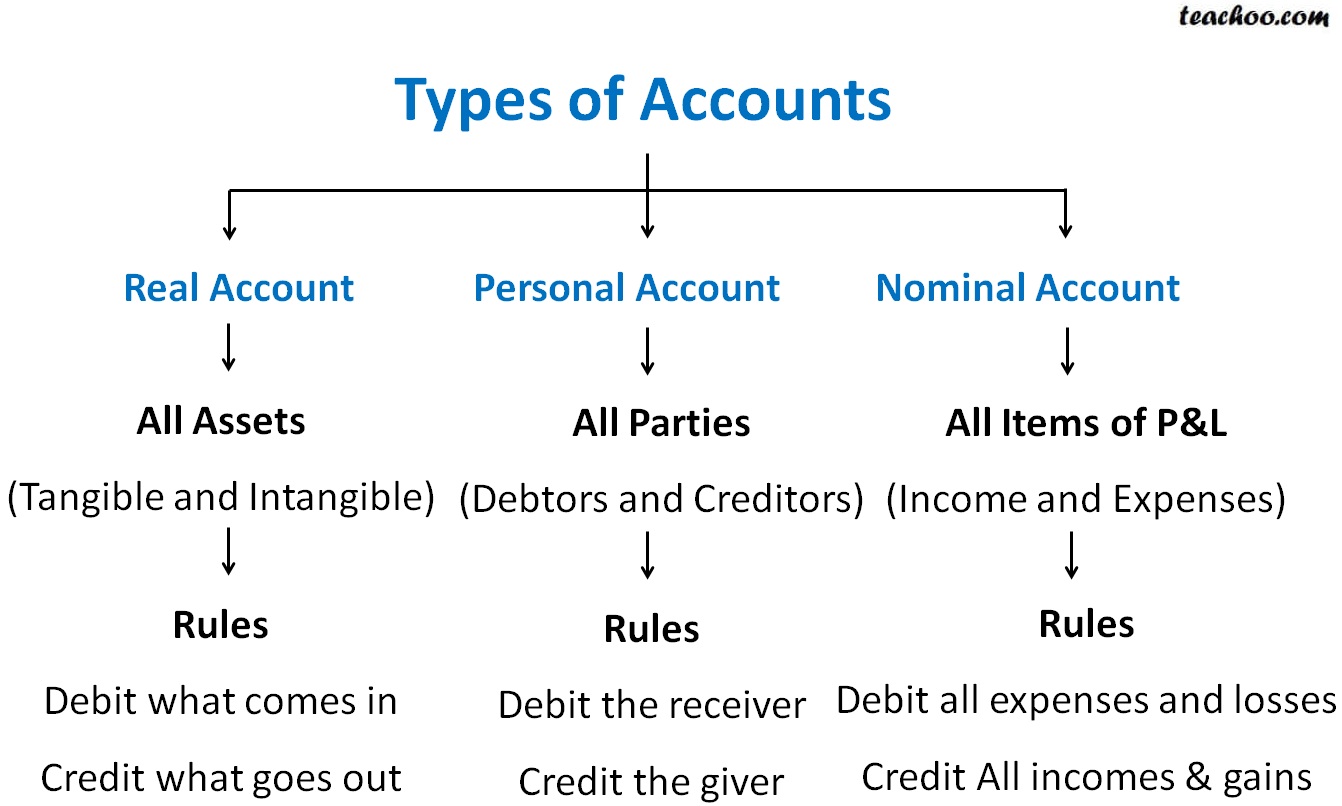

However, they also must respect the guidelines set out by the Financial Accounting Standards Board (FASB) and generally accepted accounting principles (GAAP). An expense account balance, for example, shows how much money has been spent to operate your business, whereas a liabilities account balance shows how much money your business still owes. In accounting, each transaction you record is categorized according to its account and subaccount to help keep your books organized. These accounts and subaccounts are located in the COA, along with their balances. COAs are typically made up of five main accounts, with each having multiple subaccounts. The average small business shouldn’t have to exceed this limit if its accounts are set up efficiently.

- For bigger companies, the accounts may be divided into several sub-accounts.

- A chart of accounts organizes your finances into a streamlined system of numbered accounts.

- The chart of accounts serves as the backbone for accurate financial reporting, compliance with accounting standards, and efficient financial management.

List: How Do You Create a Chart of Accounts?

Each account in the chart of accounts is usually assigned a unique code by which it can be easily identified. This identifier can be numeric, alphabetic, or alphanumeric, with each digit/letter typically representing the type of account, company division, region, department and other classifiers. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

A chart of accounts is organized using a hierarchical structure, starting with broad categories and then breaking them down into more specific subcategories. This structure generally follows a numerical system, with each account assigned a unique number. The numbering system typically groups accounts of the same type together, making it easier to navigate and maintain the chart. what are management skills and why are they important In conclusion, integrating your Chart of Accounts with accounting software like QuickBooks Online significantly improves the efficiency and accuracy of financial management. By setting up a well-structured COA in the software and integrating third-party applications where necessary, businesses can optimize their financial management processes and make better-informed decisions.

Summarizing Accounts for Financial Statements

For example, a company might use prefix numbers for specific accounts, such as cash. Here’s an example with the first 10 representing assets and the second 10 representing cash. Today, businesses manage countless complex and multifaceted financial transactions. To keep track of everything, finance teams rely on a chart of accounts (COA) to help them organize, record, and monitor these transactions accurately.

Liability accounts usually have the word “payable” in their name—accounts payable, wages payable, invoices payable. “Unearned revenues” are another kind of liability account—usually cash payments that your company has received before services are delivered. The general ledger provides a comprehensive view of your financial activities.

The structure of the COA also promotes financial transparency and accountability, fostering trust among stakeholders. This systematic categorization aids in adhering to regulatory requirements, facilitates in-depth financial analysis, and supports informed decision-making. Additionally, by streamlining accounting processes, the COA enhances efficiency and minimizes errors – a critical advantage for businesses with complex transactions. To maintain financial transparency and accuracy, it is essential for an organization’s COA to adhere to the Generally Accepted Accounting Principles (GAAP). GAAP guidelines help ensure the uniformity and comparability of financial reporting, making it critical for accounting and auditing professionals to abide by these established principles.

Accounting systems have a general ledger where you record your accounts to help balance your books. Keeping your accounts in place and up-to-date is important for analyzing your finances. The trial balance lists all the accounts and the debits and credits related to them. Expense Accounts – These are the main expenses of a business and include general office expenses, utilities, wages, travel and insurance. Cost of Sales – These are the costs that relate directly to the income accounts and might include wages, parts and packaging. The group refers to the categorization of the account into one of the headings shown below.